Does it mean that the cloud is yet another fashion tech trend everyone is speaking about but no one knows how to use? Does it actually affect business profitability? Or do the costs of using it exceed potential outcomes? And most importantly, if all the advantages are true, how can banks implement that technology most painlessly? In this article, we will try to answer these types of questions.

To better understand why banks are still struggling with cloud adoption, we should look closely at three major fears.

-

The slow and expensive cloud adoption

Lack of expertise and fear of unexpected expenses may delay cloud adoption. Executives must weigh the total cost and possible benefits of migration. And the more time-consuming this route is, the more doubts may appear in the minds of those responsible for these decisions.

The cloud migration period could take up to several years, notably in big companies. There is a risk of the inadequacy of investment, especially in a time of financial crisis and decreased margin. And it may become the breaking point that will postpone this process until a better time.

-

Lack of clarity in regulations

Another reason for delaying migration is struggling to navigate changing regulations and standards. Due to the importance of the banking system to national stability, the government is strict and narrow in its permissions. While technology develops by leaps and bounds, the law slows down companies' innovations. It makes them take a risk-based approach before implementing cloud decisions.

For example, in some countries, banks may be forced to store certain customer data on servers located on national soil. And those laws may pressure a company's strategy of adopting cloud technology.

-

Cloud Security Risks

While security is third on that list, it may be the most important reason. When banks host their data on-premise, they have total control over their safety. When they move data to the cloud, they double the number of potential vulnerabilities. Hackers may not only steal credentials by using fishing or social engineering. They can also find breaches in cloud misconfiguration. A 2022 IBM survey showed the latter caused 15% of data breaches in the last year.

According to an IBM report, an average compromised account costs $150. It can be translated into tangible financial losses if we speak about banks with millions of clients.

In March 2019, Capital One Bank suffered a massive data breach that exposed the personal data of over 100 million US and Canadian customers. Hackers got access to Capital One's cloud computing systems and compromised information related to credit card applications from 2005 until 2019. That breach cost the bank $190 million, which it agreed to pay in a settlement.

Yet, you shouldn't take this as if the cloud is incompatible with banking security standards. It all depends on the company's strategy and where it puts its cybersecurity. Not only those associated with the cloud.

In its 2021 report, Accenture noted that although security breaches are a common problem for the industry, a staggering 32% of companies don't even discuss security when they talk about cloud adoption. Nevertheless, 83% of so-called "Cyber Champions" (the most successful companies in cyber resilience) move to the cloud with security in mind, compared to the 70% industry average.

The conclusion is obvious. The more you worry about your customer's data, the fewer leaks you get. Returning to the Capital One Bank case, the plaintiff accused the company of knowing about specific vulnerabilities but doing nothing about them.

It is worth mentioning that such challenges are only delaying cloud adoption. Nevertheless, the number of companies that transfer their workload and data into the cloud is constantly growing. A McKinsey 2020 survey showed that 54% of C-level executives expect to move at least half of their IT footprint to the cloud. IDC predicts that by the end of 2024, public cloud spending among banks will increase to 22% of their overall IT budgets.

So why do banks still rely on this technology after all the potential threats? What benefits can exceed potential risks and force executives to move forward with cloud adoption?

Cost-saving benefits of implementing a cloud strategy (short-term results)

The replacement of legacy systems may seem frightening and costly. Still, the ability to reduce power consumption, the number of physical servers, and operating personnel may pay back the costs of migrating to the cloud in the short term. By transferring customers' data to the cloud, companies can cut their storage costs by at least 20%. Sometimes by as much as 65%. But it is more important that all those savings will have an immediate effect.

Take a look at this comparison by Accenture. In old-style traditional banks, about 45% of their data spending goes to physical servers and software to operate them. Cloud providers could decrease that number by half.

Hardware and software support is another expense that costs companies a third of their on-premise storage budget. Cloud support usually costs half as much.

The only constant item of expenditure is the data team. In both cases, banks still need someone to operate and analyze the information, whether it's on-premise or cloud storage.

As a result, we get 40% less spending thanks to migration. Besides, the cloud can help avoid ongoing costs of 7% to 12% every year. It will be possible due to the lower cumulative annual growth rate of the marginal cost compared to on-premises and greater cost transparency.

Cloud technology as banks' future (long-term results)

While all those savings may be significant and instant, the business needs to also look at the long term. Legacy systems are what held banks in the past. And sooner or later, most of them will move their core to the cloud. According to Accenture, 82% of finance executives plan to have at least half of their mainframe workloads in the cloud by 2032. The third of them has already achieved this by the beginning of 2022.

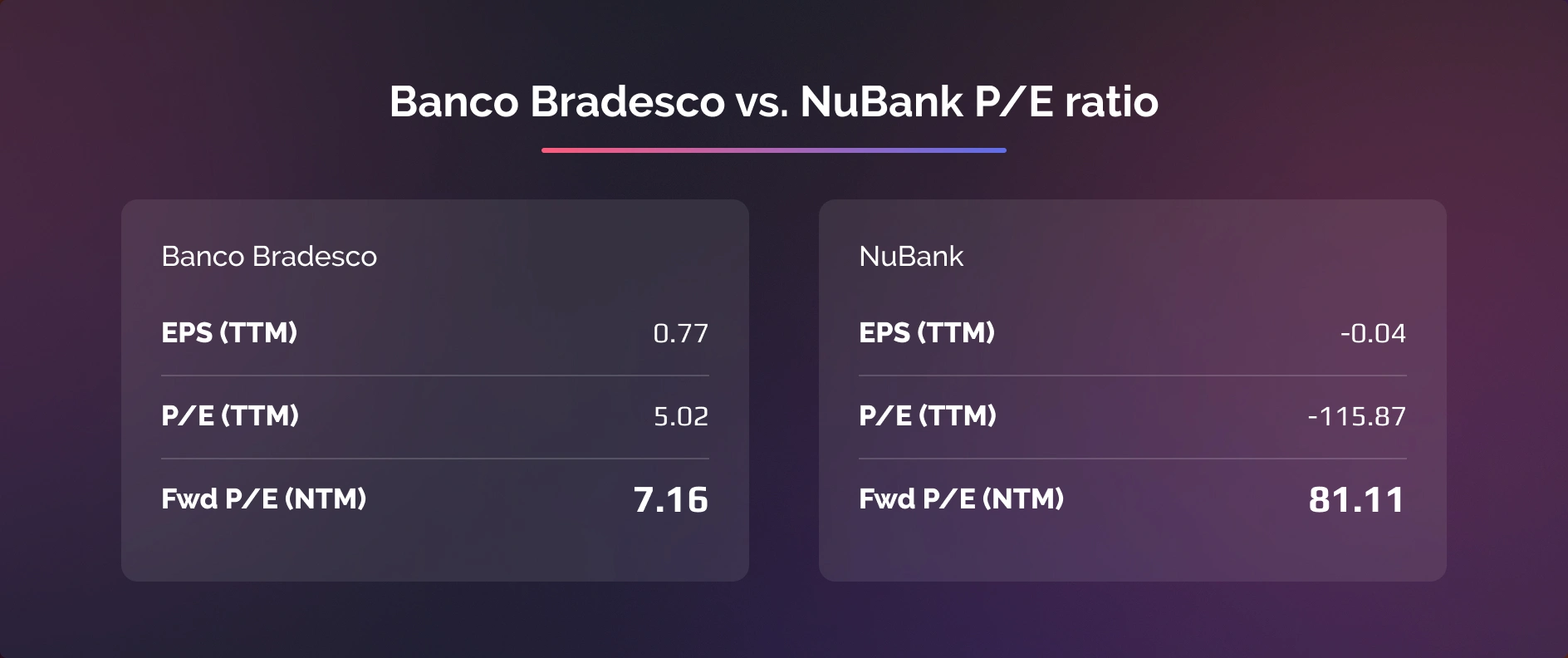

Keeping up with technological innovations may affect company capitalization. The investors' evaluation of FinTech is significantly higher than that of the classic financial sector. Let's compare, for example, two competing banks from the same country but with entirely different models and approaches. Unfortunately, major NA and EU neo-banks (such as Chime, Kurrent, and Monzo) haven't been listed on the stock exchange yet. Still, we may analyze the latest share prices of Brazilian neo-bank Nubank and compare them to the third biggest traditional Brazilian bank, Banco Bradesco, whose stocks are also traded on the NYSE.

Nubank got listed on the New York Stock Exchange in December 2022. For this reason, we will compare future P/E ratios instead of traditional ones, as annual reports are not yet available. 7.16 in Banco Bradesco against a staggering 81.11 in Nubank. In addition, if we analyze North American banks, their standard P/E ratio ranges from 5 to 15. This data shows a valuation difference between FinTech and the traditional banking sector.

Investors have great faith in the technological revolution in the banking sector. Thus, managers must keep up with new technologies and adopt them in their companies.

Many decades ago, banks were at the cutting edge of innovation. The introduction of a credit card, an ATM, and the first banking computerization in the 1960s changed the world forever. But those times are in the past. Today, traditional banks look like obsolete vestiges. Neo-banks and so-called "challenger banks" are at the forefront of financial innovation today.

FinTech is hitting hard. The only way traditional banks can win this battle is to fight the new threats with their weapons.

The speed of developing new features or even products may become crucial in this battle. The cloud allows companies to avoid wasting weeks building out new infrastructure. They can quickly use out-of-the-box solutions, run their tests, analyze the results, and implement them.

It is worth noting the possibilities of dealing with abnormal loads and the potential downtime periods the cloud opens up (especially in the case of multi-cloud).

Banks can considerably reduce service disruptions by using different cloud providers instead of relying on one vendor. According to a Google survey, 17% of companies in the field of financial services were using multi-cloud solutions as early as mid-2021. 88% of those not using such solutions were considering doing so in 2022.

Another reason for adopting the cloud is the possibility of an uncanny level of personalization. Powerful cloud computing could simultaneously track millions of activities and significantly increase customer insights. It helps customer retention and avoids potential security breaches by monitoring suspicious actions.

It brings us to the point where potential financial savings from detecting abnormal activities may outweigh the potential security risks associated with cloud technologies.

Traditional on-premise solutions may appear more stable and secure. In practice, the cloud makes a vast difference in data availability and durability.

There is the capability to increase computing capacity during periods of abnormal loads, enhanced data recovery by synchronized storage across multiple facilities, and built-in solutions to detect irregular activity. That is the unquestionable benefit of AWS, Microsoft Azure, and the Google Cloud Platform.

The cloud is not only about cutting costs. It's a way to reorganize your company and make it more competitive. This journey may take several years, though. Especially if there is a need to re-architect old legacy applications to cloud-native ones. That's why executives should carefully choose reliable developers to do this job.

First, American banks should narrow their search to outsourcing and outstaffing companies with offices in North America. This way, they will be subjected to the same legal regulations. Moreover, it'll be easier to communicate with them, which can be critical in long-term projects.

UUUSoftware is one such company. We are located in Toronto, a two-hour flight from the headquarters of all the central US banks. Our team has extensive experience in finance and cloud technology.

So, how can a bank implement cloud technologies with minimal distress?

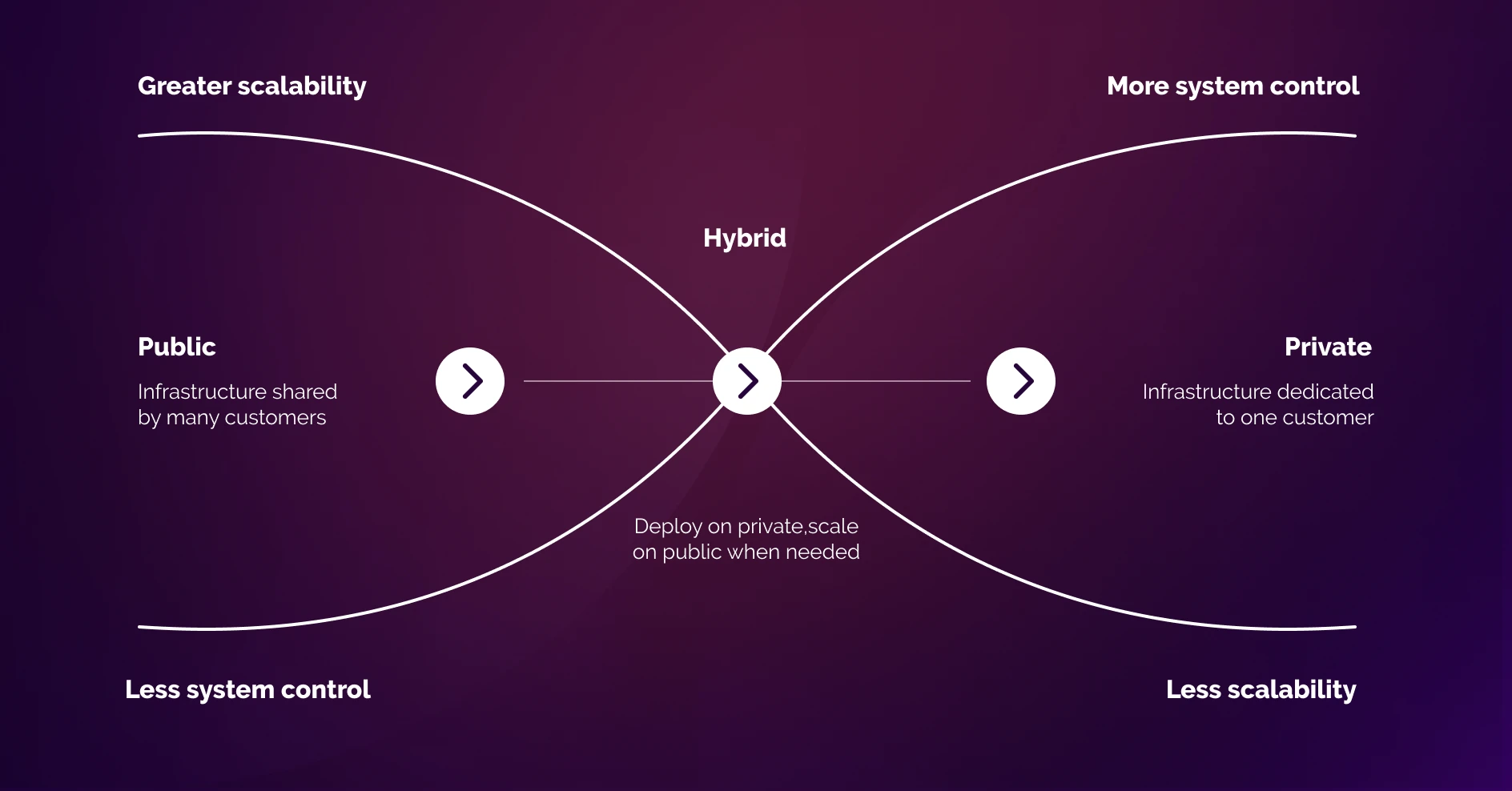

Companies must determine which of their operations can be moved to the public cloud and which ones should remain on-premises. Because, regardless of the benefits of the cloud, the security and regulatory issues that come with its implementation cannot be ignored.

For this reason, more and more companies are opting for a hybrid approach. It combines the agility of the public cloud with the security of the private one.

To implement a hybrid approach, the bank must go through the following steps:

-

Decide on a cloud provider and an integrator.

Since there are three key players in the market (Amazon, Microsoft, and Google), banks should consider their differences and the solutions they provide. Which one is best suited for financial organizations and specific bank needs?

As for the development team, managers should focus on onshore companies. They should have experience in implementing cloud technologies and updating the bank's core systems.

-

Design a governance model.

Banks can increase management transparency by creating clear rules on who and how can access customers' data. They also need to set the permissions for using the cloud resources. These actions, in turn, will help to manage further upgrades and reduce the number of potential bugs.

-

Double-check all the applications before going live.

Look before you leap. Ascertain that your integration went smoothly and that all systems are operational.

-

Prepare a plan "R."

You could decide for yourself what "R" stands for - "restoration," "rescue," or "recovery." But whatever you choose, you should have a contingency plan in place.

-

Keep an ear to the ground.

Constantly measure the impact of cloud adoption on banking processes and efficiency. Technologies tend to change quickly. Your task is to ensure that they fully meet your company's needs.

Even though adopting cloud technologies is full of uncertainties and risks, today it is no longer a question of "should a company use the cloud or not?". The question is "when?"

If you are considering the cloud or have questions about how this technology can bring maximum benefit to your company, write to us. We will be glad to answer all your questions. With over 15 years of experience working with financial institutions and over 150 completed projects, we would be happy to help your company as well.